NORTHEAST BANCORP /ME/ (NBN)·Q2 2026 Earnings Summary

Northeast Bank Posts Record Loan Volume Despite EPS Decline as Government Shutdown Hits SBA Gains

January 27, 2026 · by Fintool AI Agent

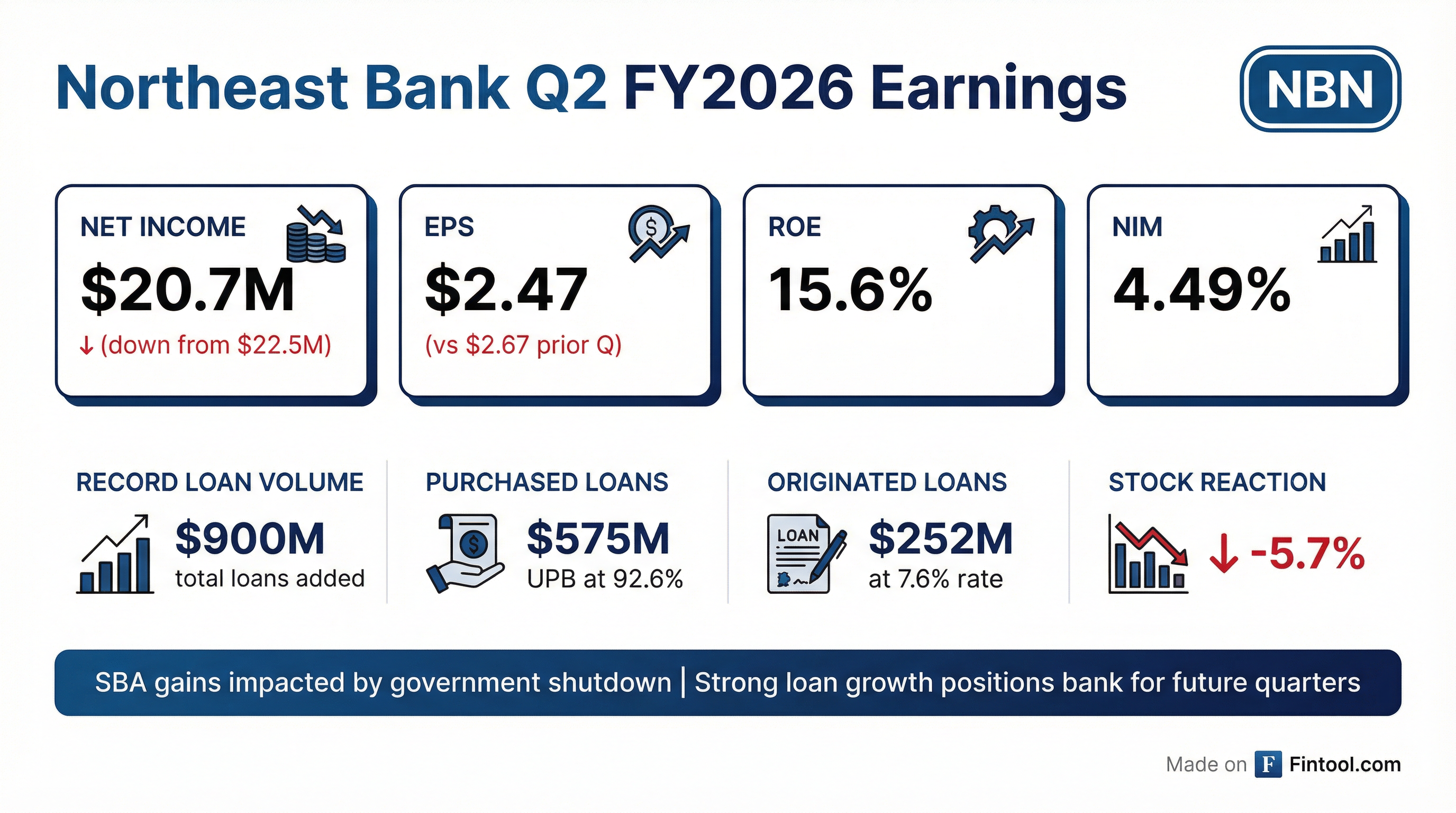

Northeast Bank (NBN) delivered a tale of two narratives in Q2 FY2026: record loan volume of nearly $900 million contrasted with lower earnings as the federal government shutdown hammered its SBA lending business. Net income came in at $20.7 million ($2.47 EPS), down from $22.5 million ($2.67 EPS) last quarter, but management emphasized significant tailwinds for upcoming quarters as the loan book now sits at $4.4 billion.

Did Northeast Bank Beat Earnings?

No. Northeast Bank's Q2 FY2026 results came in below recent quarters:

*Estimated from transcript references

The primary driver of the earnings miss was a $6 million decline in SBA loan gains compared to the June 2025 quarter—equivalent to approximately $0.50 per share on an after-tax basis.

What Caused the Earnings Decline?

Two factors converged to pressure SBA gains this quarter:

1. Government Shutdown (Oct 1 - Nov 12): The federal government shutdown severely limited SBA loan originations. During this period, the bank could only originate loans where they had already obtained an SBA number and tax return transcripts. Most loan activity was compressed into November 12 - December 31.

2. SBA Rule Changes (July 1): New SBA regulations restructuring the small balance program required more documentation and longer underwriting times, continuing to suppress volumes.

*Reference from Q1 FY2026 transcript

Management expects SBA originations to return to a $20 million per month run rate (~$50-60M per quarter) now that the government has reopened, with gains maintaining an 8-9% margin on guaranteed balances sold.

What Changed From Last Quarter?

The headline story is massive balance sheet growth:

Loan volume details:

-

Purchased Loans: $575M UPB acquired at $533M basis (92.6% of par), with 10.8% weighted average yield to maturity. 152 loans across 5 transactions, concentrated in New York and New Jersey. 80% came from loan funds exiting bank portfolios.

-

Originated Loans: Record $252M at 7.6% weighted average rate. 32 loans with average balance of $7.5M and LTVs just over 50%. Two-thirds were lender financed.

-

Insured Loan Product: $71M originated—a new small business loan product with private insurance (4% deductible + 10% coverage = 14% protection).

Critical timing note: Most purchases occurred at the very end of December, meaning the ending loan balance of $4.4B was approximately $500 million higher than the average loan balance for the quarter. This muted net interest income in Q2 but sets up significant tailwinds for Q3.

What Did Management Guide?

Management did not provide explicit EPS guidance but offered strong qualitative commentary on the outlook:

Net Interest Income Tailwinds:

- $500M higher ending loan balance vs. average should drive "significantly more net interest income in the following quarters"

- $1.25B in CDs maturing over the next 6 months at a weighted average rate of 4.05%—repricing opportunity as rates decline

Purchase Pipeline:

"The current pipeline is as full as we've ever seen... Bank M&A is up 45% in 2025 over 2024, and 2026 is shaping up to be even bigger." — Pat Dignan, COO

SBA Recovery:

- $20M/month run rate expected for SBA originations going forward

- Gain on sale expected to remain at 8-9% of guaranteed balance

Capital Position:

- Just under $1 billion of remaining loan capacity as of December 31

How Did the Stock React?

NBN shares fell 5.7% on earnings day, declining from $114.25 to $107.74.

The stock has traded in a volatile range since hitting its 52-week high of $121.48 in recent weeks, reflecting elevated expectations heading into earnings. The reaction suggests investors focused on the earnings miss rather than the growth story.

Key Management Quotes

On the earnings shortfall:

"While we present quarterly numbers and get judged on a quarterly basis, this quarter, our operating results were a little bit lower than they have been in the previous quarters. I want you to consider kind of not thinking about us at a quarter at a time, but thinking over just a slightly longer time frame." — Rick Wayne, CEO

On funding strategy:

"Brokered deposits... had a bad name. But I don't think it's really the case anymore that it deserves it now. It's a very efficient way of funding without all the costs of either an online presence and marketing or brick-and-mortar space." — Rick Wayne, CEO

On the insured loan product:

"The demand for it is gigantic. The reality for us is we got to be able to sell it... We've got to intentionally kink that firehose. We're really slowing the incoming volume down until we can prove to ourselves that we can sell these loans." — Rick Wayne, CEO

Asset Quality Update

Asset quality remained stable despite the rapid loan growth:

The allowance increase was "largely provided for as part of the purchase loan activity during the period." A single purchased loan accounted for $1.2M of the charge-offs but had been previously reserved.

Delinquencies, non-accruals, and classified loans all remained "relatively flat quarter over quarter."

What's Next for Northeast Bank?

Near-Term Catalysts:

- NII acceleration from $500M higher loan balances flowing through Q3

- SBA normalization as government reopening enables full origination capacity

- CD repricing with $1.25B maturing over 6 months at 4.05%

- Insured loan sales — first sales expected soon, with potential 2-2.5% spread economics

Key Risks:

- Payoff acceleration if rates continue declining — management noted borrowers negotiating harder on prepayment terms

- Insured loan execution — the product is new and sales mechanism unproven

- CRE concentration — significant exposure to New York/New Jersey commercial real estate

The Bottom Line

Northeast Bank's Q2 FY2026 represents a classic "investment quarter" — near-term earnings pressured by external factors (government shutdown) while the balance sheet expanded substantially. The bank added nearly $900 million in loans, including purchased assets at attractive 7%+ discounts, positioning it for significantly higher interest income in coming quarters.

The key question for investors: Does the 5.7% stock decline adequately price in the SBA headwinds, or does it create an opportunity given the robust purchase pipeline and $1.25 billion CD repricing tailwind? Management's three-year track record of 17.7% average ROE and 2% ROA suggests they've earned the benefit of the doubt on execution.

More on Northeast Bank: